The Basics of Smart Contracts and Their Key Functions Explained

What Are Smart Contracts? A Simple Overview

At their core, smart contracts are self-executing contracts with the terms of the agreement directly written into code. Think of them like a digital vending machine: once you input the right amount of coins, out pops your snack without any need for a middleman. This technology allows for trust and transparency, significantly reducing the need for intermediaries.

Smart contracts are a revolutionary way of making agreements, eliminating the need for trust between parties by replacing it with code.

Smart contracts operate on blockchain technology, which ensures that once a contract is deployed, it cannot be altered or tampered with. This immutable nature creates a secure environment for transactions, making it a popular choice in various industries. In a world where trust is sometimes hard to come by, smart contracts provide a reliable solution.

Moreover, these contracts can automate processes, reducing the time and effort involved in traditional agreements. For instance, instead of waiting for a bank to verify and process a transaction, a smart contract can execute it instantaneously when predetermined conditions are met.

How Do Smart Contracts Work? The Mechanics Explained

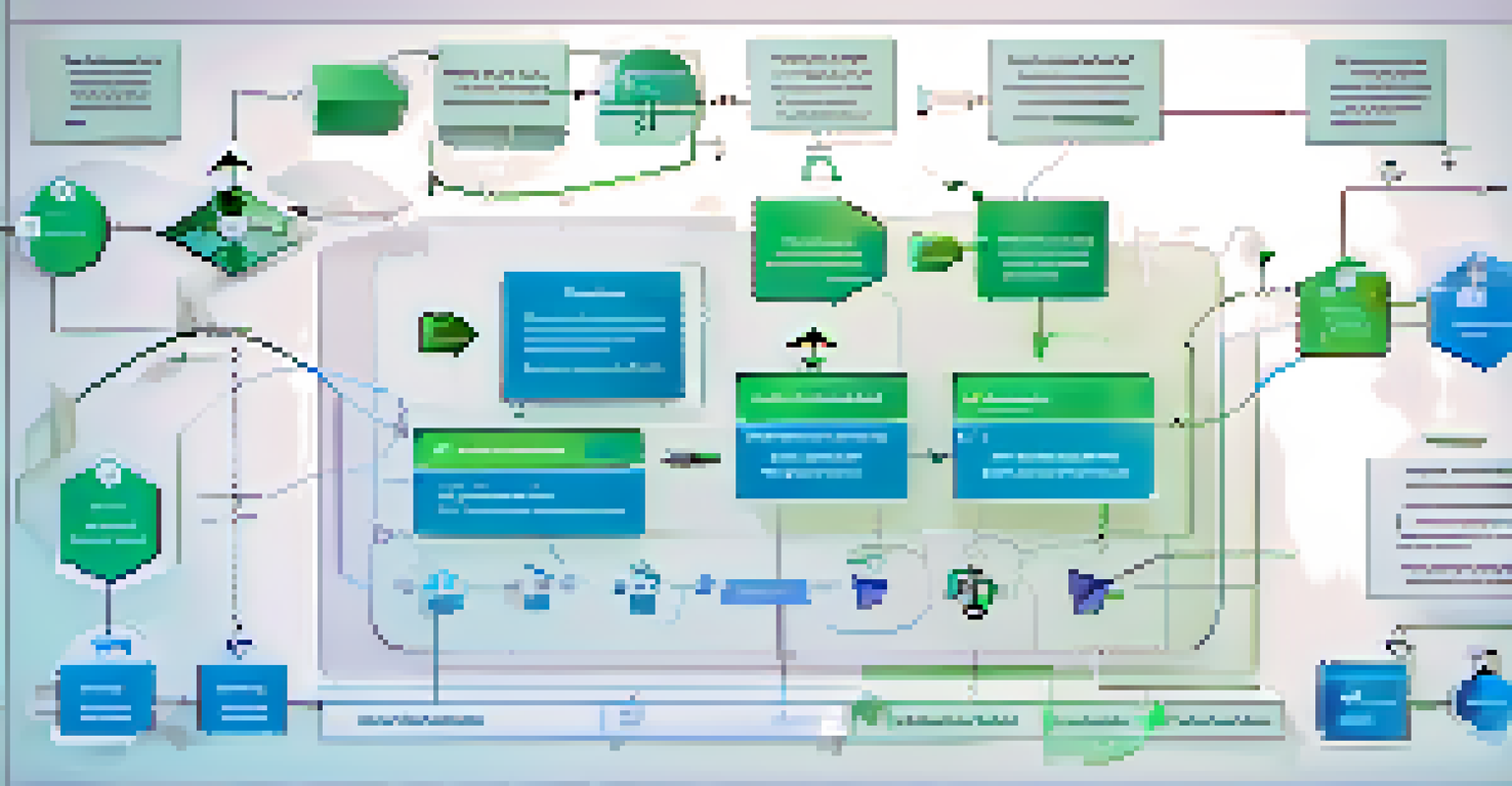

Smart contracts work through a series of 'if-then' statements coded into the blockchain. For example, if a user pays for a service, then the contract automatically executes the service delivery. This straightforward logic eliminates ambiguity and ensures that all parties are held to their commitments.

Once the conditions are met, the smart contract is triggered, and the results are recorded on the blockchain. This process is not only quick but also less prone to errors compared to manual processing. It’s like having a digital referee that ensures everyone plays by the rules.

Smart Contracts Automate Agreements

Smart contracts execute automatically when specific conditions are met, streamlining processes and reducing the need for intermediaries.

Furthermore, because smart contracts are decentralized, they operate across a network of computers, making them resistant to fraud and censorship. This decentralized nature is a fundamental shift from traditional contracts, where a single entity often holds power over the agreement.

Key Functions of Smart Contracts in Various Industries

Smart contracts have found applications across various sectors, from finance to supply chain management. In finance, for example, they can facilitate peer-to-peer lending, allowing individuals to lend money directly without banks taking a cut. This opens up more opportunities for both lenders and borrowers.

We know that smart contracts will help us build a new financial system and remove intermediaries to create a more efficient economy.

In supply chain management, smart contracts can enhance transparency and efficiency. They can automatically update stakeholders about the status of goods as they move through the supply chain, reducing delays and disputes. Imagine being able to track your package in real-time without constantly contacting customer service.

Additionally, real estate transactions can also benefit from smart contracts. They can streamline the buying process by automatically transferring ownership once payment is confirmed, eliminating lengthy paperwork and the risk of fraud.

Benefits of Using Smart Contracts in Business

One of the most significant benefits of smart contracts is their ability to reduce costs. By eliminating intermediaries, businesses can save time and money while streamlining operations. Think of it as cutting out the middleman to maximize your profits.

Another advantage is increased accuracy. Since smart contracts are coded, there's less room for human error, ensuring that all terms are executed as intended. This precision can be critical in high-stakes environments where the smallest mistake can lead to significant losses.

Broad Applications Across Industries

From finance to real estate, smart contracts enhance efficiency and transparency, transforming how transactions are conducted in various sectors.

Lastly, smart contracts enhance security. The decentralized nature of blockchain technology means that contracts are stored across a network rather than on a single server, making them less vulnerable to hacking or data breaches. In a digital age where data theft is rampant, this added layer of protection is invaluable.

Challenges and Limitations of Smart Contracts

Despite their many advantages, smart contracts are not without challenges. One major hurdle is the reliance on accurate and verifiable data inputs, commonly referred to as 'oracles.' If the data feeding into the contract is incorrect, it can lead to unintended consequences, much like following a faulty recipe.

Furthermore, the legal status of smart contracts is still a gray area in many jurisdictions. While they are gaining recognition, not all legal systems fully understand how to interpret them, which can lead to complications in enforcement. This uncertainty may deter some businesses from fully embracing the technology.

Lastly, the complexity of coding smart contracts can be a barrier for many. Not every business has the technical expertise to create these contracts, which can limit their adoption. However, as technology evolves and more resources become available, this barrier is likely to decrease.

Real-World Examples of Smart Contracts in Action

One notable example of smart contracts in action is the Ethereum platform, which allows developers to create decentralized applications (dApps) that utilize smart contracts. A famous dApp is CryptoKitties, a game that lets users buy, sell, and breed virtual cats using smart contracts. This fun application showcases the versatility of smart contracts beyond financial transactions.

Another example is the use of smart contracts in the insurance industry. Companies like Etherisc are developing solutions where insurance claims can be processed automatically based on predefined criteria, such as flight delays. This not only speeds up claims but also improves customer satisfaction, as policyholders receive their payouts without lengthy claims processes.

Challenges of Smart Contract Adoption

Despite their benefits, smart contracts face challenges such as reliance on accurate data inputs and unclear legal status in many regions.

Real estate transactions are also becoming more efficient thanks to smart contracts. Companies like Propy are enabling cross-border property sales where buyers and sellers can transact without intermediaries, simplifying a traditionally complex process. This innovation is paving the way for a more accessible real estate market.

The Future of Smart Contracts: Trends and Predictions

As we look ahead, the future of smart contracts appears promising. With the rise of decentralized finance (DeFi), more businesses are likely to leverage smart contracts to facilitate complex financial transactions without traditional banking systems. This shift could democratize access to financial services, particularly in underserved regions.

Moreover, advancements in technology, such as artificial intelligence and machine learning, may enhance the capabilities of smart contracts. Imagine contracts that can learn from past transactions and adjust themselves accordingly, leading to more intelligent and adaptive agreements.

Finally, as regulatory frameworks around blockchain technology evolve, we may see increased adoption and integration of smart contracts in various industries. As businesses become more comfortable with the legal implications, we can expect a broader acceptance and utilization of this innovative technology.